- Home

- Operations

- Philippines

Philippines

MANKAYAN COPPER-GOLD PORPHYRY DEPOSIT

(Updated 28 March 2025 refer to our announcements page for subsequent updates)

Introduction

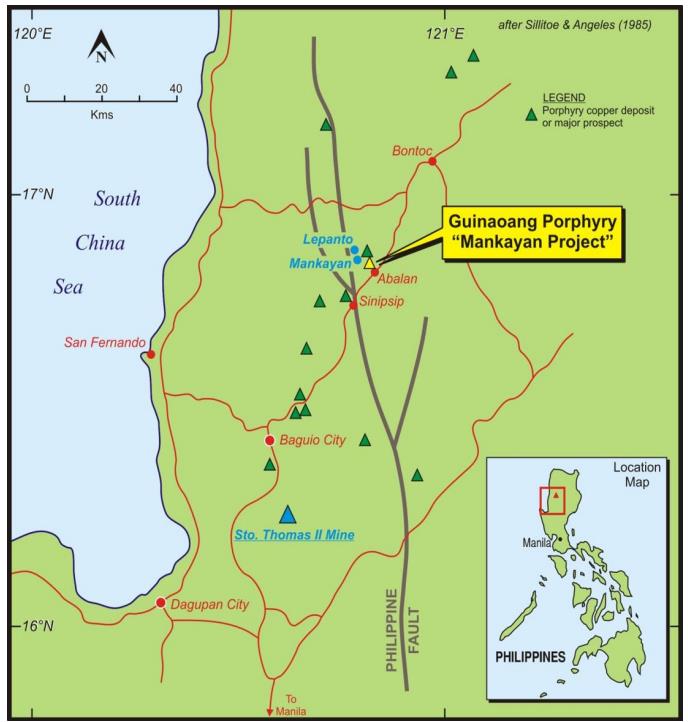

Situated in the heart of the prospective Mankayan Mineral District in Northern Luzon, Philippines, the Mankayan copper-gold project is regarded as one of the largest undeveloped copper-gold porphyry mining projects in the world. The project holds a 25-year mining licence (MPSA) and is strategically positioned near major operating mines, including the Lepanto epithermal deposit and Gold Fields Far Southeast porphyry deposit.

Bezant Resources holds an indirect stake in the Mankayan copper-gold porphyry project through its 22.96% shareholding in IDM International Limited (idminternational.com.au), who are the operator of the project. On 6 February 2025, IDM announced a proposed merger agreement with ASX-listed Blackstone Minerals LTD. Under the terms of the merger, shareholders will receive 7.4 Blackstone shares for every 1 IDM share that they own.

On 5 February 2025, Bezant converted its AUD137,500 IDM Convertible Loan Note (plus accrued interest) and received 752,143 IDM shares and 343,750 options to acquire IDM shares at AUD0.40, expiring on 5 February 2029 (“IDM Loan Note Conversion”).

Prior to the IDM Loan Note Conversion, Bezant owned 19,381,054 IDM shares, recognized in its 2023 accounts at AUD 0.20 per share, equal to £2,072,000. The AUD137,500 IDM Convertible Loan Note was recognized in Bezant’s 2023 accounts at £78,000.

If the merger is completed, Bezant will receive 148,985,657 Blackstone shares and 2,543,750 options to acquire Blackstone shares at AUD0.06, expiring on 5 February 2029, for its IDM shares and IDM options.

The Blackstone merger is expected to provide the catalyst required to advance Mankayan forward towards the operational stage.

The combined JORC (2012) compliant Indicated and Inferred mineral resource estimate for the project stands at an impressive 793 million tonnes of ore grading at 0.64% CuEq, for a total of 2.8Mt of contained copper, 9.7Moz of contained gold, and 20Moz of contained silver, at a 0.25% CuEq cut-off.

Over 56,800m of diamond drilling has been completed on the resource, and detailed mining studies project the deposit to be beneficially exploited via underground shaft and block-caving methods. IDM International is currently completing advanced scoping, prefeasibility, geotechnical, and metallurgical studies on the project.

The Philippines boasts a rich mining history and is known to be the 5th most mineralized country in the world, with a supportive jurisdiction that highlights mining as an economic priority.

Figure 1. Location of the Mankayan Copper-Gold Project in the Luzon Province of the Philippines (Source: IDM International)

Tenure

The Mankayan Project covers is held under Mineral Production Sharing Agreement MPSA 057-96-CAR, totalling 458ha, and was renewed to Crescent Mining Development Corporation (a subsidiary of IDM) for a second 25-year term with effect from 12 November 2021. A Mineral Production Sharing Agreement (MPSA) is a mining right which grants the contractor (in this case Crescent) the right to conduct mining operations within a contract area.

Background Geology

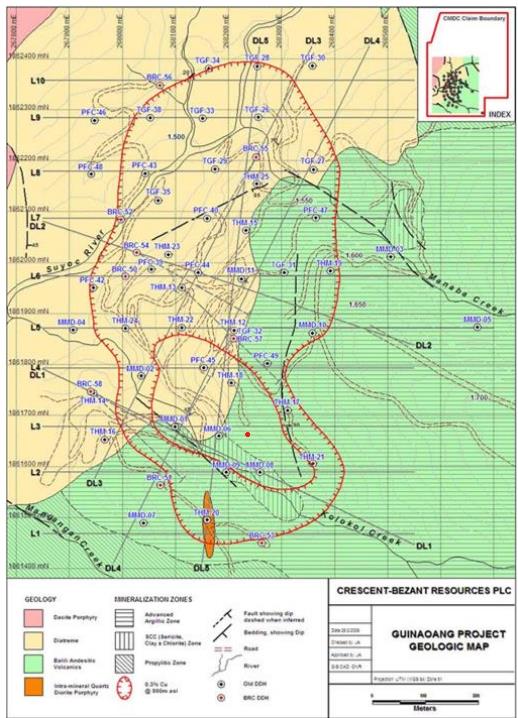

The copper mineralisation encountered at Mankayan is emplaced along the southeastern extension of the Lepanto fault, which is also host to the Far Southeast and the Lepanto deposits. The deposit is typical of porphyry copper-gold deposits in the region and is characterised by two distinct phases of igneous intrusion. Both intrusive complexes host copper and gold mineralisation and are largely composed of quartz diorite porphyry rocks, detailed as;

- A primary hornblende quartz diorite porphyry (QDP), described locally as the sun-mineral quartz diorite porphyry

- A later quartz diorite porphyry (IDQ), that has intruded the QDP body in the southern part of the project area, described as the intra-mineral quartz diorite porphyry

The most important host for the copper mineralisation is the QDP, with the IQD containing lower grade mineralisation. The immediate volcanic host rocks surrounding the plutonic rocks are also mineralised in proximity to the diorites.

The Mankayan intrusive complex occupies an area that broadly strikes north-south, and is of sub-vertical orientation. The porphyry is roughly 900m long and 400m wide in plan section, and surface outcrop is limited. The plutonic bodies are located roughly 200m to 400m below the surface, and extending to a depth of around 1,100m deep, where the deposit remains broadly open.

Figure 2. Project geology of the Mankayan deposit

Figure 3: High-grade Gold-Copper Ore from Mankayan porphyry (Source: IDM International)

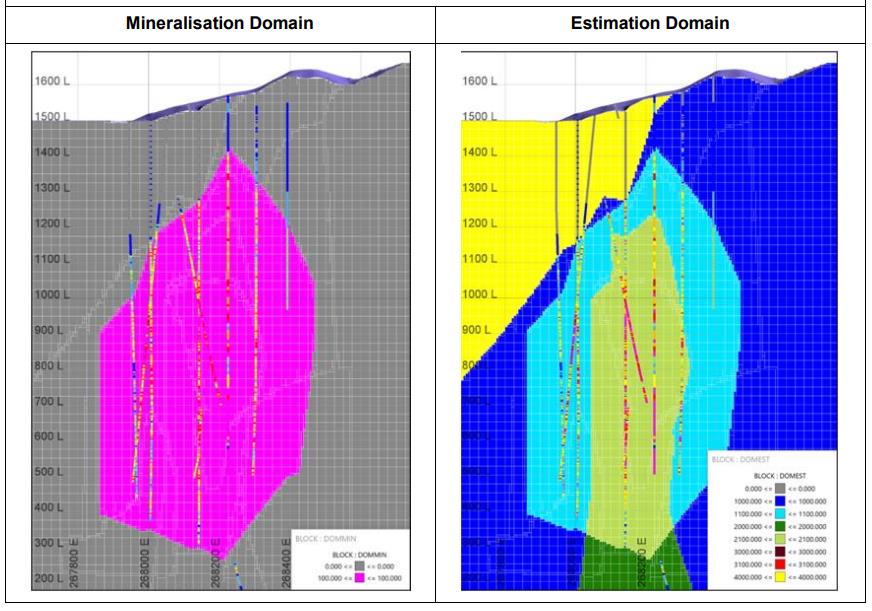

Figure 4. East-west cross section at 1861990 mN (Source: Derisk, 2020 – Mineral Resource Estimate for the Mankayan Project)

JORC (2012) COMPLIANT MINERAL RESOURCE

Mankayan is estimated to have combined Mineral Resources of 793 million tonnes containing 2.8Mt of copper, 9.7Moz of gold and 21Moz of silver. It has an Indicated Mineral Resource of 638Mt @ 0.37% Cu, 0.40g/t Au and 0.90g/t Ag, and an Inferred Mineral Resource of 155Mt @ 0.29% Cu, 0.30g/t Au and 0.5g/t Ag.

Further potential remains to extend the resource through additional drilling, as well as delineating higher grade copper-gold zones within the deposit as a potential focus for mining start-up.

Table 1: JORC (2012) Combined Indicated and Inferred Mineral Resource for the Mankayan Resource (Source: IDM International)